Valiant INSIGHT™

The Future For Advanced Default Loan Management

Email To Workflow

- Loan Portfolio of 110k - 1 Million

- Manual Intervention

- Resource Req

From $0.25 Per Loan

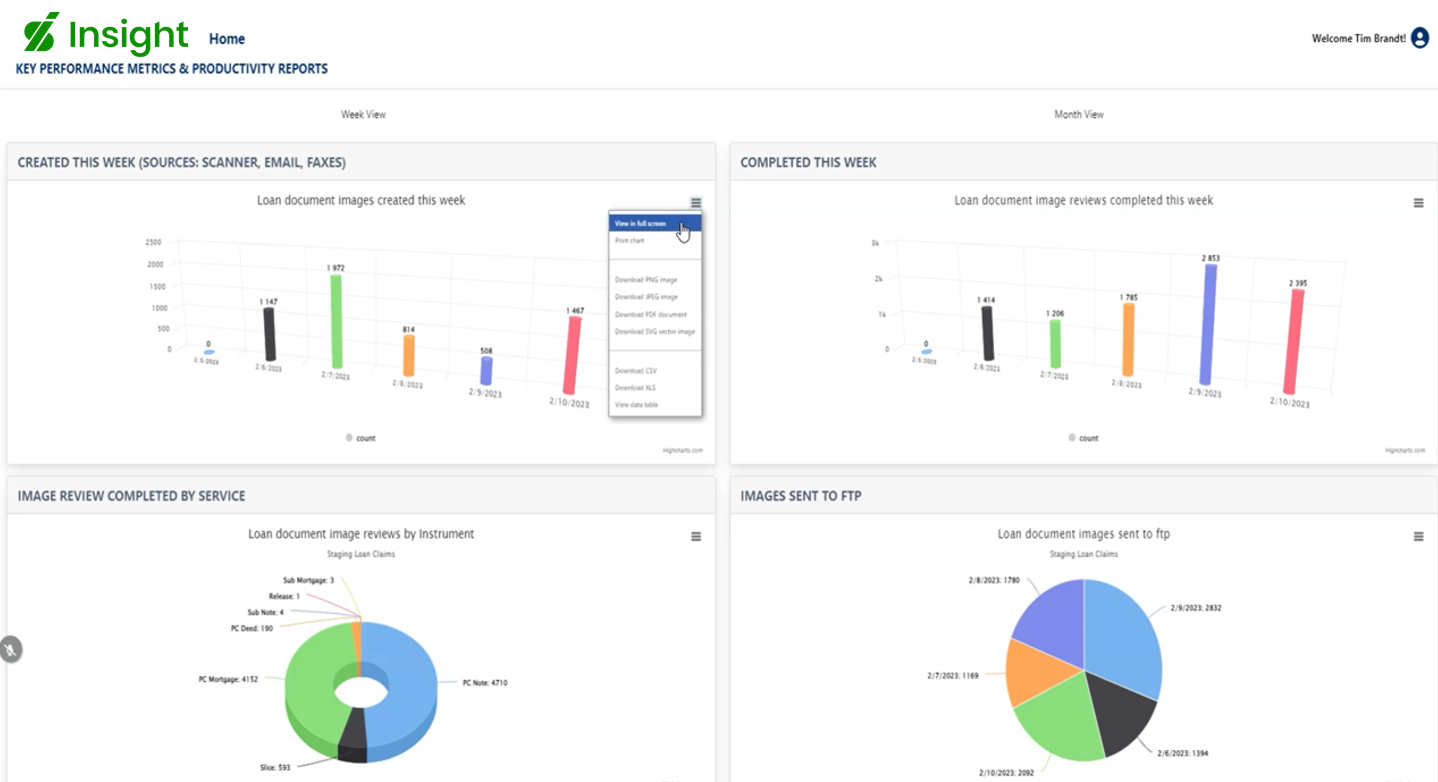

Data Analytics

- Trend Tracking

- Process Improvement

- Daily, Monthly YTD Reporting

From $0.27 Per Loan

Document Management Module

- Automated Document Imaging

- Optimal Character Recognition

- High Quality Text Searchable PDFs

From $0.30 Per Loan

Property Preservation

- Lien Releases

- Home Inspections

- Maintanence

From $0.35 Per Loan

Foreclosures

- Foreclosure Process & Deadlines

- Foreclosure Mediation

- Loss Mitigation

From $0.35 Per Loan

REO

- Managed Corrections & Exceptions

- Sync All Parties Data

- Titles & Evaluations

From $0.35 Per Loan

Valiant Aims To Deliver The Best

Developing the comprehensive servicer and consumer functionality of INSIGHT doesn’t happen overnight. It’s the result of long-term client partnerships and continual improvement based on daily client feedback.

Modules Available For Deployment

Cash Management

- Data Analytics

- Document Management

- E-Recording Solutions

- Deeds

- Lien Releases

- Satisfaction Of Mortgage

- Assignments

- Email/Fax to Workflow (EFW)

- File Audit Management

- Lien Release Management

- Payoffs

- Property Reservation

- Bankruptcy

- Advanced Business Analytics

- Workflows

- Decision Tracking

- Foreclosure

- Litigation

- Loss Mitigation

- Portfolio Monitoring

- HOA

- Taxes

- Death

- Bankruptcy

- Subordination

FEATURES OF THE VALIANT INSIGHT™ PLATFORM

Portfolio Services

Effortlessly configure to each process for swift adaptation and seamless operations.

Fully Real Time Data

Access fully real-time data for instant insights and informed decision-making.

Workflow Automation & Management

Streamline workflow automation and management for enhanced efficiency.

Full Loss Mit Lifecycle

Manage the full loss mitigation lifecycle with precision and effectiveness.

Full Foreclosure Lifecycle

Navigate the entire foreclosure lifecycle with confidence and ease.

Full Bankruptcy Lifecycle

Handle the complete bankruptcy lifecycle with thoroughness and accuracy.

More

Mission &

Vision

Mission

Our mission at Valiant Insight is to empower financial institutions to navigate borrower hardships with confidence and efficiency. We aim to achieve this by delivering a comprehensive digital management platform that streamlines processes, enhances transparency, and enables continuous progression through various default phases. Through innovative solutions and tailored configurations, we strive to empower stakeholders with the tools they need to mitigate losses, protect investments, and foster financial stability in communities worldwide.

Vision

To revolutionize consumer loss mitigation by providing a seamlessly integrated digital platform that empowers financial institutions, borrowers, investors, vendors, and regulators with unparalleled insights and tools for effective management throughout the entire default lifecycle.

Let's Connect

We’re seasoned experts in loan servicing who understand your need. Let’s collaborate and exchange insights on our respective endeavors. How can we assist you?